When Sarah Martinez decided to start a microschool in Columbus, Ohio, she spent three weeks calling every state office trying to find "microschool regulations." The Ohio Department of Education told her microschools don't exist. Her local school district told her to contact the state. The fire marshal told her to check with zoning. The zoning office told her to talk to the fire marshal.

Sound familiar?

Here's what Sarah eventually discovered: Ohio doesn't regulate microschools because Ohio doesn't recognize microschools as a legal category. But that's actually good news. The confusion Sarah faced is exactly what every Ohio microschool founder experiences. But once you understand Ohio's three legal pathways, the mystery disappears and the opportunity becomes clear.

You've got the vision. A small, personalized learning community where every student gets the individual attention they deserve. You've researched microschools, connected with other founders, and you're ready to take the leap in Ohio. But then you hit the wall: regulations.

Here's the frustrating truth. Ohio doesn't officially recognize "microschools" as a category. When you search the Ohio Department of Education website, you won't find a "microschool registration form" or a "microschool compliance checklist." According to Lacey Snoke of the Ohio Department of Education and Workforce, "State law does not include provisions for microschools; therefore, the Ohio Department of Education does not oversee or track them."

But here's the opportunity hidden in that confusion: flexibility. Ohio has approximately 30 operating microschools right now, all working within existing legal frameworks that give you three distinct pathways to launch legally and sustainably. Some require virtually no state oversight. Others offer access to state funding programs like EdChoice scholarships worth up to $8,407 per high school student. The key is choosing the right pathway for your vision and capacity.

Understanding Ohio microschool regulations matters because it helps you avoid costly mistakes, make informed decisions about accreditation, access Ohio's expanding school choice funding (including a $250 homeschool tax credit with proposals to increase it to $2,000), and build a sustainable, compliant educational model that serves families for years to come.

This guide covers everything you need to know: three legal pathways for microschools in Ohio, registration and licensing requirements by pathway, teacher qualification options, curriculum and assessment requirements, facility and safety compliance, access to Ohio school choice programs, and a step-by-step startup checklist.

By the end of this guide, you'll understand Ohio's three legal structures for microschools, know exactly which registration path fits your vision, have a clear compliance checklist for your chosen pathway, understand how to access Ohio education funding options, and know where to get official help and resources.

Ohio's Legal Framework: Three Pathways for Microschools

The "microschool gap" in Ohio law creates both confusion and opportunity. While the Ohio Capital Journal reports that "Ohio law does not provision for microschools, so the department of education does not track or oversee them," this doesn't mean microschools operate in a legal gray area. Instead, they operate under one of three existing private school frameworks, each with distinct requirements and benefits.

Here's the counterintuitive truth: Ohio's lack of microschool-specific regulations is actually an advantage. While states like California and New York have added layers of bureaucracy to microschools, Ohio lets you choose from three existing, well-established private school frameworks—each with clear rules, tested legal precedents, and decades of operational history.

Think of it like choosing a hiking trail. Ohio gives you three marked paths to the same destination. One path (homeschool co-op) is easy and fast. Another path (nonchartered school) has moderate terrain with some requirements. The third path (chartered school) is steep but offers the best view—and potential state funding.

Most Ohio microschool founders start with Pathway 1 (homeschool co-op) when they're testing their concept with 5-10 families. As they grow to 15+ students and want more structure, they transition to Pathway 2 (nonchartered school). Only schools that need state funding or want the credibility of accreditation pursue Pathway 3 (chartered school).

Pathway 1: Homeschool Cooperative Structure

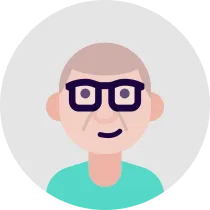

The homeschool cooperative model operates under Ohio's individual homeschool law. This is the simplest, most flexible pathway with minimal state oversight. It's ideal for parent-led instruction models serving small groups of 5-15 students where families seek maximum flexibility and don't need state funding.

No state registration is required. Instead, each participating family independently registers as a homeschool with their local school district superintendent during the first two weeks of the school year. The co-op itself doesn't register or report to the state. Parents maintain attendance records as a personal responsibility, and there are no teacher credential requirements. According to the National Microschooling Center, 55% of microschools nationally operate under homeschool frameworks.

Key statutes: Ohio Revised Code 3321.12 governs compulsory attendance and homeschool notification requirements.

Pathway 2: Nonchartered Nonpublic School (NCNP)

The nonchartered nonpublic school pathway, commonly called an "-08 school" after Ohio Administrative Code 3301-35-08, offers moderate state requirements with a religious beliefs exemption option. This pathway works well for faith-based or values-driven missions serving 15+ students or 3+ grade levels where moderate oversight is acceptable.

Schools self-certify compliance with minimum standards by filing an annual "report to parents" with the Ohio Department of Education and Workforce by September 30. According to the Home School Legal Defense Association, the "truly held religious beliefs" exemption provides flexibility while maintaining minimal standards. Teachers must hold bachelor's degrees from recognized colleges or universities, but state teaching licenses are not required.

Key requirements per ORC 3301.0732: At least 15 students OR 3 grade levels; instructional hours ranging from 455 (part-time kindergarten) to 1,001 hours (grades 7-12); curriculum must include geography, U.S. and Ohio history, and government; and schools must maintain 182+ school days annually.

Pathway 3: Chartered Nonpublic School

The chartered nonpublic school pathway requires the highest regulatory compliance but offers access to state funding programs. According to Ohio Administrative Code 3301-35-09, chartered schools must achieve accreditation through either the Ohio State Board of Education or a recognized third-party accrediting agency like Cognia, the Association of Christian Schools International (ACSI), or the American Association of Christian Schools (AACS).

This pathway suits schools seeking state accreditation, plans to access EdChoice scholarships (currently $6,165 for K-8 students and $8,407 for high school students), and willingness to meet higher regulatory standards. New chartered schools must contact the Ohio Department of Education for "beginning a chartered nonpublic school" training at (614) 728-2678 or Chartered.nonpublic.schools@education.ohio.gov.

Recent regulatory updates: Ohio lawmakers expanded EdChoice eligibility to 450% of the poverty line through the 2023 state budget (House Bill 33), making the program functionally universal for Ohio families. Additionally, House Bill 110 established a $250 annual homeschool tax credit, with Senate Bill 11 proposing to increase it to $2,000.

Startup Requirements by Pathway

Pathway 1: Homeschool Cooperative

Who this fits: Parent-led instruction models, small groups (typically 5-15 students), families seeking maximum flexibility, and those not desiring state funding.

Registration process: The co-op itself does not register with the state. Instead, each family independently notifies their home school district superintendent during the first two weeks of the school year, providing the child's name, age, and residence (ORC 3321.12). Individual responsibility means each family registers as a homeschool, not through the co-op.

Legal structure options: No formal business structure is required. Optionally, founders can establish an LLC for liability protection ($99 filing fee with Ohio Secretary of State) or a nonprofit corporation for fundraising capability ($125 filing fee).

Costs: Registration fees at the state level are $0. Optional business entity filing costs $99-125. Liability insurance (recommended but not required) runs $500-$2,000 annually.

Step-by-step checklist:

- Determine co-op meeting location (home, rented space, church)

- Recruit participating families

- Each family notifies their school district superintendent

- Establish shared curriculum and teaching schedule

- (Optional) File LLC with Ohio Secretary of State

- (Optional) Obtain liability insurance

- Establish attendance tracking system

- Begin instruction (minimum 455-1,001 hours per year recommended)

Processing time: Immediate—no state approval needed.

Pathway 2: Nonchartered Nonpublic School (-08 School)

Who this fits: Faith-based or values-driven missions, situations where moderate oversight is acceptable, schools serving 15+ students or 3+ grade levels, and those who may seek tuition-based funding later.

Registration process: Schools must file an annual "report to parents" certification with the Ohio Department of Education and Workforce by September 30 (OAC 3301-35-08). Ohio does not provide an official certification form. According to the Home School Legal Defense Association, HSLDA members can access sample templates to modify for their use, or schools can contact the Ohio Department of Education at NCNPschools@education.ohio.gov or (614) 728-2678 for guidance.

Religious beliefs exemption: Schools operating under "truly held religious beliefs" qualify for exemption from state charter requirements while maintaining minimal standards. This provides significant flexibility in curriculum and operational approach.

Minimum requirements per ORC 3301.0732:

- Enrollment: At least 15 students OR 3 grade levels

- Instructional hours: Part-time kindergarten requires 455 hours; all-day K-6 requires 910 hours; grades 7-12 require 1,001 hours

- School days: 182+ school days annually

- Teacher qualifications: Bachelor's degree or equivalent from recognized college or university (not a state teaching license—just a bachelor's degree in any discipline)

- Curriculum: Must teach geography, U.S. and Ohio history, and government

Legal structure options: LLC (recommended for liability protection), Nonprofit Corporation (501(c)(3) for tax-exempt status), or Sole Proprietorship (individual ownership).

Paperwork timeline:

- Months 1-2: Establish legal entity, secure facility

- Month 3: Begin hiring process (verify bachelor's degrees)

- Month 4: Develop curriculum aligned with Ohio requirements

- August: Prepare for school year launch

- September 30: File annual certification with ODE

Costs: Ohio LLC filing ($99), nonprofit incorporation ($125), annual certification filing ($0—no state fee), facility costs (variable), insurance ($1,500-$5,000 annually).

Step-by-step checklist:

- Form legal entity (LLC or nonprofit) with Ohio Secretary of State

- Secure facility (verify local zoning compliance)

- Develop curriculum including required subjects

- Hire teachers with bachelor's degrees

- Establish attendance tracking system (182-day requirement)

- Create parent handbook documenting policies

- File annual certification report by September 30

- Report enrollment to local school district (ORC 3321.12)

Processing time: No state approval needed; self-certification model.

Pathway 3: Chartered Nonpublic School

Who this fits: Schools seeking state accreditation, plans to access EdChoice scholarships and state funding programs, willingness to meet higher regulatory standards, and schools serving 15+ students or 3+ grade levels.

Registration process: Contact the Ohio Department of Education for "beginning a chartered nonpublic school" training. Email Chartered.nonpublic.schools@education.ohio.gov or call (614) 728-2678 or (877) 644-6338. New schools must complete training before beginning the accreditation process.

Accreditation requirement: Schools must achieve accreditation via the Ohio State Board of Education or a recognized third-party accrediting agency. Recognized accreditors include Cognia/AdvancED, the Association of Christian Schools International (ACSI), and the American Association of Christian Schools (AACS). According to the National Microschooling Center, 78% of microschools operate without accreditation, and "microschools, learning pods, hybrid academies, and online-only programs don't always fit neatly into Cognia's framework."

Comprehensive curriculum requirements per OAC 3301-35-09:

- Language arts (reading, writing, grammar)

- Geography

- U.S. and Ohio history

- National, state, and local government

- Balanced presentation of contributions by African, Mexican, Puerto Rican, American Indian, and other ethnic and racial groups

- Mathematics (all grade-appropriate levels)

- Natural science (biology, chemistry, physics, earth science)

- Health education

- Personal safety and assault prevention (grades K-6)

- Physical education

- Fine arts (including music)

- First aid

- School day minimum: Grades 7-12 must have at least 5-hour instructional day (excluding lunch)

Paperwork timeline:

- Months 1-3: Initial planning, legal entity formation

- Months 4-6: Curriculum development, facility selection

- January-April: Submit "Notice of Intent Form" for state accreditation

- Months 7-12: Complete accreditation petition process

- Year 2+: Ongoing compliance and annual reporting

Costs: Legal entity filing ($99-$125), accreditation fees ($2,000-$10,000 varies by accreditor), curriculum development ($5,000-$15,000), facility improvements (variable), insurance ($3,000-$8,000 annually), and higher annual operating costs due to compliance requirements.

Step-by-step checklist:

- Contact ODE for new chartered school training

- Form legal entity (LLC or nonprofit)

- Develop comprehensive curriculum meeting all subject requirements

- Secure facility meeting state standards

- Submit Notice of Intent Form (January-April)

- Complete accreditation petition template

- Submit petition to appropriate accrediting body

- Receive education identification number

- Complete accreditation process (6-12 months)

- Maintain ongoing compliance and annual reporting

Processing time: 6-12 months for accreditation process.

Ohio Teacher Requirements for Microschools

Teacher Requirements by Pathway

Homeschool Cooperative Model: No certification or minimum education requirements. According to HSLDA's Ohio Homeschool Laws, parents, guardians, or adult volunteers can teach. Background checks are not mandated by state law but are strongly recommended as best practice.

Nonchartered Nonpublic School (-08): Teachers must hold a bachelor's degree or equivalent from a recognized college or university (OAC 3301-35-08). The degree can be in any discipline—not education-specific. State teaching licenses are not required, and continuing education is not mandated. This flexibility allows schools to hire subject matter experts, career changers, and experienced educators from other states.

Chartered Nonpublic School: State teaching licenses are preferred. OAC 3301-35-09 requires teachers to be "properly licensed" under state requirements, though interpretation varies by accreditor. Subject-specific credentials may be required for certain courses. According to Learn.org, "Private schools in Ohio do not require teachers to have state teaching certification. Many private institutions do not mandate state licensure, allowing schools to set their own hiring criteria."

Ohio Teacher Certification (For Chartered Schools)

If pursuing state licensure, the Ohio State Board of Education administers the educator license program. Pathways include traditional routes (bachelor's degree in education from accredited university), alternative routes (bachelor's in subject area plus educator preparation program), and alternative licensure programs for career changers and subject matter experts.

Background Check Requirements

All school types should implement FBI criminal background checks and Ohio Bureau of Criminal Investigation (BCI) checks as recommended practice. According to Ohio Department of Education guidance, licensed educators and school employees must complete background checks. House Bill 190 (note: the outline incorrectly referenced HB 79) requires the State Board of Education to request criminal record checks prior to issuing or renewing educator licenses, with mandatory updates every 5 years for professional or permanent certificates.

The process requires electronic fingerprinting at local school districts, Educational Service Centers, or local law enforcement offices. Costs typically run $50-$75, which educators pay unless the district covers the expense. For more information, visit Kent State's BCI/FBI Requirements page.

Hiring Considerations

For non-chartered schools: Verify bachelor's degrees from recognized institutions if operating as an -08 school. Conduct reference checks and thorough interviews. Implement background check policies as best practice even when not legally mandated.

For chartered schools: Prioritize licensed teachers for accreditation compliance. Verify Ohio educator licenses via the state database at the State Board of Education. Ensure subject-area expertise matches teaching assignments. Document all professional development activities.

Alternative credentials worth considering: Industry experience and subject matter expertise, professional certifications in specialized fields, advanced degrees (master's, doctorate), and teaching experience in other states or countries. According to Prenda microschool network, "About half of all guides are certified teachers and the other half are passionate parents or community members who want to make a difference for the students in their lives."

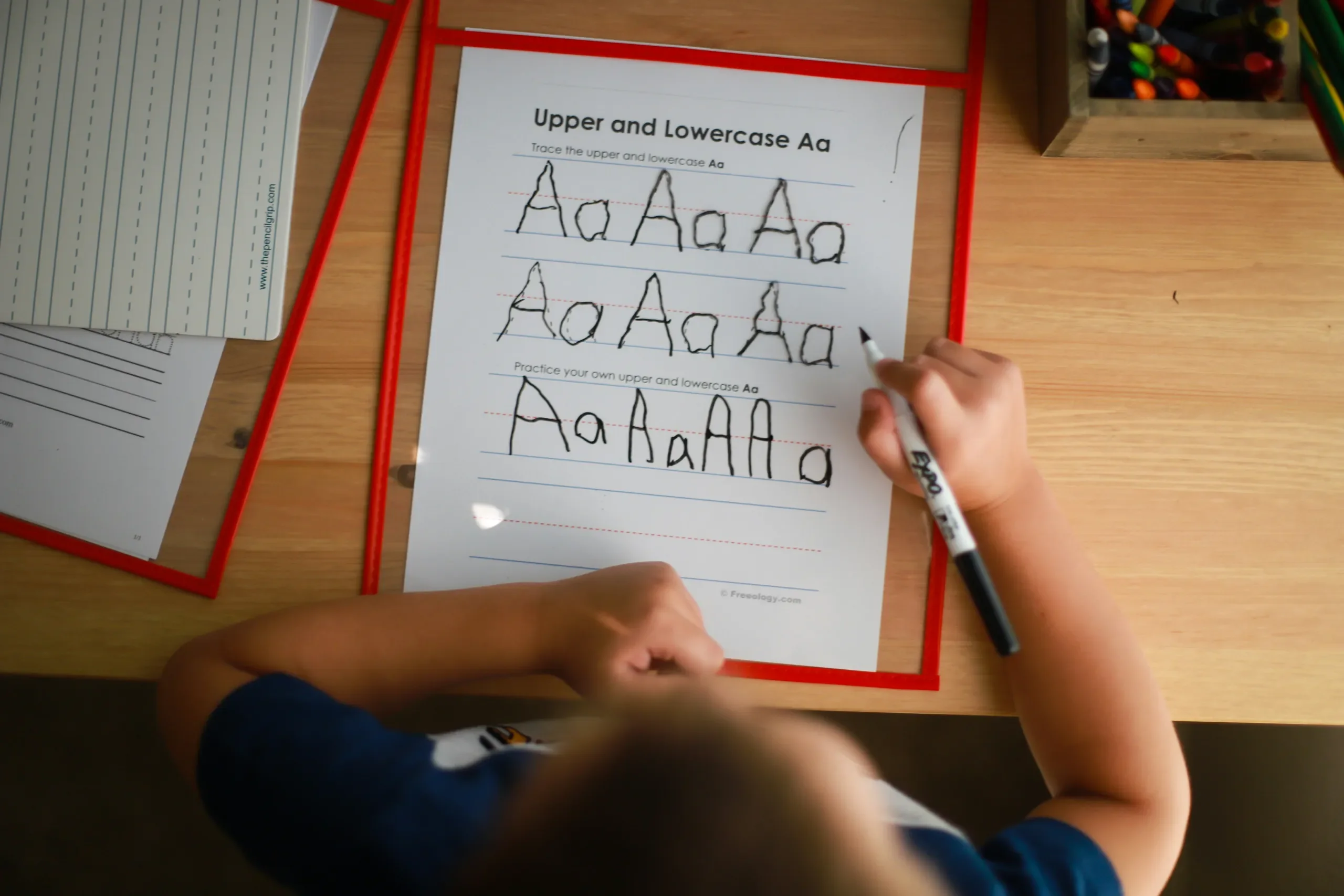

Real-World Hiring Example: Finding Your First Teacher

When Forest City Academy founder Ben Colas needed to hire his first teacher, he faced a common dilemma: Should he hire a certified teacher with traditional classroom experience, or a passionate subject-matter expert with a bachelor's degree in math?

For his -08 nonchartered school, Ohio law only required the bachelor's degree—not state teaching certification. Ben chose the math expert who had taught at the college level but never worked in K-12. "The flexibility Ohio gives us meant we could prioritize passion and subject expertise over formal credentials," Colas explains.

This is the hiring advantage of Ohio's -08 pathway: You can recruit career changers, subject experts, and passionate educators who might not have traditional teaching licenses. A former NASA engineer with a physics degree can teach science. A published author with an English degree can lead writing workshops. A CPA with an accounting degree can teach financial literacy.

The key is matching your pathway requirements to your hiring strategy. If you need maximum flexibility (hire parents without degrees), choose the homeschool co-op pathway. If you want credentialed professionals but don't need state licenses, the -08 pathway is perfect. If accreditation requires licensed teachers, pursue chartered status.

Common Hiring Mistakes to Avoid

Mistake 1: Assuming you need Ohio-licensed teachers for a nonchartered school

- Truth: Only bachelor's degree required for -08 pathway, no teaching license needed

- Cost: Missing out on talented career changers and subject experts who could excel in your environment

Mistake 2: Hiring before verifying degree authenticity

- Truth: Ohio may audit your teacher credentials during compliance reviews

- Cost: Having to terminate and rehire mid-year, damaging school reputation and continuity

- Solution: Request official transcripts directly from universities, not just diplomas

Mistake 3: Skipping background checks to save money

- Truth: Parent concerns will force you to do them anyway, and liability exposure is enormous

- Cost: Damaged reputation, enrollment drops, potential lawsuit if incident occurs

- Solution: Budget $50-$75 per teacher for FBI/BCI checks from day one

Mistake 4: Hiring too many teachers too quickly

- Truth: Microschools succeed with lean, highly effective teams (often 1-3 teachers)

- Cost: Unnecessary payroll burden ($40,000-$60,000 per full-time teacher annually)

- Solution: Start with multi-age classrooms and part-time specialists instead of full staff

Curriculum & Assessment Requirements

Required Subjects by Pathway

Homeschool Cooperative: According to the U.S. Department of Education's Ohio State Regulation page, Ohio mandates no specific subjects for homeschools. Parents have full curriculum choice with the general guidance that instruction must be "equivalent to" public schools (an undefined standard). Instruction must be in English.

Nonchartered Nonpublic School (-08): Minimum required subjects per ORC 3301.0732 include geography, history of the United States, history of Ohio, and national, state, and local government. No math, science, or language arts requirements exist at the state level. Annual instructional hours range from 455 (part-time kindergarten) to 1,001 hours (grades 7-12), with 182+ school days required annually.

Chartered Nonpublic School: Comprehensive subject requirements per OAC 3301-35-09 include language arts, geography, U.S. and Ohio history, government (with balanced presentation of diverse ethnic and racial contributions), mathematics, natural science, health education, personal safety and assault prevention (K-6), physical education, fine arts including music, and first aid. Grades 7-12 must maintain at least a 5-hour instructional day excluding lunch.

Curriculum Approval Process

Homeschool co-ops and nonchartered schools: No state approval required. Schools determine curriculum independently without submission to authorities.

Chartered schools: Curriculum must align with Ohio Academic Standards. Accrediting bodies review curriculum as part of the accreditation process. The Ohio Department of Education publishes model curriculum and academic standards that chartered schools are expected to follow.

Testing and Assessment Requirements

Homeschool cooperative: State testing is not required. Parents determine student progress independently with no test score reporting to the state.

Nonchartered nonpublic school (-08): State testing is not required. Schools determine their own assessment methods. Participation in Ohio state testing is not mandatory.

Chartered nonpublic school: Schools may optionally participate in Ohio's achievement tests for grades 3-8 by submitting a written request to the superintendent prior to August 1 each year. For high school graduation, students must either score remediation-free on nationally standardized assessments in English, Mathematics, and Reading; achieve specified scores on end-of-course examinations; or attain workforce readiness on a nationally recognized job skills assessment (ORC 3313.6029). Test results must be reported to parents by June 30.

Reporting Requirements

Annual certification (nonchartered schools - ORC 3301.0732): By September 30 each year, schools must submit certification that they meet minimum education standards to both parents of pupils and the Ohio Department of Education and Workforce. Ohio does not provide an official certification form. According to HSLDA, members can access sample templates, or schools can contact NCNPschools@education.ohio.gov for guidance.

Attendance reporting (all private schools - ORC 3321.12): Within the first two weeks of the school year, the school principal or teacher in charge must report to the treasurer of the local school district board of education. Required information includes names of all pupils below age 18, ages of pupils, and places of residence. Mid-year enrollment or withdrawal changes must be reported within the first week of the next school month. For nonchartered schools, ORC 3301.0732 notes that "parents of a child enrolled in a nonchartered nonpublic school shall be responsible for reporting their child's enrollment or withdrawal," though schools may provide the report "as a matter of convenience" on behalf of parents.

Ohio Facility & Safety Requirements

Physical Space Requirements

Homeschool cooperative and nonchartered schools: No state facility requirements exist. No state inspections are mandated. Schools are subject to local codes only.

Chartered nonpublic schools: Schools must comply with Ohio State Board of Education facility rules, fire prevention commission requirements, Ohio Department of Health requirements, and Occupational Safety and Health Administration (OSHA) standards. Facility assessments are required as part of the accreditation process.

Facility Selection Horror Story (And How to Avoid It)

A Cincinnati microschool founder signed a 2-year commercial lease for $3,000/month before checking local zoning. The space was zoned "light industrial"—educational use prohibited. After spending $15,000 on facility improvements, the city planning department issued a cease-and-desist order.

The founder had three options: (1) Apply for costly rezoning ($5,000+ legal fees, 6-month process, no guarantee), (2) Relocate and lose all deposits and improvements, or (3) Shut down.

She chose option 2. Total cost: $33,000 lost.

The Single Most Important Facility Rule: Call your local planning and zoning department BEFORE signing any lease or making any facility commitments. This 15-minute phone call could save you tens of thousands of dollars.

Here's exactly what to ask:

- "I'm planning to operate a small private school with 15 students ages 6-12. Is educational use permitted at [specific address]?"

- "Do I need a conditional use permit or zoning variance?"

- "What are the parking requirements for educational facilities?"

- "Are there any special signage restrictions?"

- "Who should I contact at the fire marshal's office before finalizing the space?"

Where Ohio Microschools Actually Meet

Based on research of operating Ohio microschools:

- 40% operate from church facilities (often free or low-cost rental)

- 30% use commercial office or retail space

- 20% operate from founder's homes (zoning permitting)

- 10% use community centers, libraries, or shared spaces

Smartest Strategy for Year One: Start with a church or community center rental (often $0-$500/month) for your first year. This gives you time to build enrollment and revenue before committing to expensive commercial leases.

Many churches actively seek weekday programming and welcome microschools. They often provide:

- Pre-approved educational use zoning

- Free or heavily subsidized rent

- Built-in parking and restrooms

- Community connections for enrollment

- Liability insurance already in place

Finding church partners: Contact local churches with education ministries, weekday preschool programs, or underutilized space. Offer to share custodial costs or provide after-school programming for church families.

Local Zoning Considerations

Critical local compliance varies by municipality. You must verify requirements locally before facility selection. Contact your local planning and zoning department to determine:

- Is educational use permitted in your zoning district?

- Is a conditional use permit required?

- What are parking requirements (spaces per student or staff)?

- What are occupancy limits for the building?

- Are there signage restrictions?

- What's the distinction between residential and commercial use?

Home-based microschools: Verify home-based business allowances. Check occupancy limits for residential structures. Understand parking and traffic restrictions. Consider neighbor impact and proactive communication.

Commercial space: Verify educational use zoning approval. Obtain certificate of occupancy for educational facility. Meet parking lot requirements. Secure fire marshal approval (see below).

Fire and Building Codes

All school types must comply with Ohio Building Code requirements (note: the outline incorrectly referenced Indiana Building Code). Local fire marshals conduct inspections for buildings serving students. Changes must be completed before occupancy.

Fire marshals inspect:

- Fire extinguisher placement and certification

- Emergency exit routes and signage

- Smoke detectors and alarm systems

- Sprinkler systems (if required by building code)

- Maximum occupancy compliance

- Emergency evacuation plan posted

Building code requirements include:

- Accessibility (ADA compliance)

- Adequate ventilation and lighting

- Proper egress (emergency exits)

- Electrical and plumbing systems

- Structural safety standards

Before selecting a facility:

- Contact local fire marshal for pre-inspection guidance

- Review local building codes for educational facilities

- Budget for fire safety equipment ($500-$3,000)

- Plan for potential building modifications ($1,000-$20,000+)

Health and Safety Regulations

Sanitation standards: Clean and safe drinking water, adequate restroom facilities (ratio to students), food service safety if providing meals, and regular cleaning and maintenance.

Health department requirements: Local health departments may conduct facility inspections. Immunization record policies are at school discretion for private schools. Communicable disease policies should be documented.

OSHA standards (if operating as business): Employee safety requirements, hazardous materials handling, first aid kit availability, and incident reporting procedures.

Home-Based vs. Commercial Space

Home-based advantages: Lower overhead costs, familiar comfortable environment, easier startup process, and potentially fewer regulatory hurdles.

Home-based disadvantages: Zoning restrictions may prohibit educational use, limited space for growth, homeowner's insurance may not cover business use, and fire marshal may still require inspection.

Commercial space advantages: Clear separation of business and personal, professional environment, scalability for enrollment growth, and easier to obtain proper insurance.

Commercial space disadvantages: Higher rent and utilities ($1,000-$5,000/month typical), lease commitments (usually 1-3 years), more extensive building code compliance, and higher insurance costs.

Critical recommendation: Consult with your local planning/zoning authority AND fire marshal before signing any lease or making facility commitments. This single step can save you thousands of dollars and months of frustration.

Ohio Microschool Operations & Compliance

Attendance Tracking Requirements

All private schools must maintain accurate daily attendance records (ORC 3321.12 and ORC 3301.0732). Records must be available upon request from the State Superintendent of Public Instruction, local school corporation superintendent, or Ohio Department of Education and Workforce. No specific state-approved format is required. System options include paper logbooks, Excel spreadsheets, or student information system software.

According to Ohio Department of Education guidance, NCNP schools must maintain 182+ school days annually or meet hourly equivalents (455-1,001 hours depending on grade level).

Record-Keeping Mandates

Essential records to maintain:

Student enrollment records: Student name and date of birth, parent/guardian contact information, enrollment and withdrawal dates, previous school information for transfers, and emergency contact information.

Attendance records: Daily attendance logs, absence documentation (excused vs. unexcused), tardy arrivals and early dismissals, and total days/hours of instruction per student.

Academic records (recommended): Student transcripts and grade reports, assessment results, progress reports to parents, and teacher observations and notes.

Teacher/staff records: Educational credentials (degrees, licenses), background check results and dates, employment contracts, and professional development records.

Facility and safety records: Fire marshal inspection reports, emergency evacuation drill logs, incident and accident reports, and maintenance and safety checklists.

Record retention: Student records should be kept for 5-7 years after graduation or withdrawal. Financial records require 7 years (IRS requirement). Employment records should be maintained for duration of employment plus 3-7 years.

The $750/Year Tech Stack That Keeps You Compliant

You don't need expensive student information systems to stay compliant in Ohio. Here's the minimal tech stack that covers all requirements for nonchartered schools:

Google Workspace ($12/month = $144/year):

- Google Sheets for attendance tracking (daily logs, automated calculations)

- Google Drive for record storage (7-year retention, unlimited storage)

- Gmail for parent communication and reporting

- Google Calendar for school year planning (182-day requirement tracking)

- Shared team drives for teacher collaboration

Jotform ($35/month = $420/year):

- Student enrollment applications (collect all required information)

- Emergency contact forms (parent signatures, medical info)

- Parent handbook acknowledgments (digital signatures)

- Teacher employment applications

- Annual certification report template

QuickBooks Self-Employed ($15/month = $180/year):

- Tuition payment tracking (income by student)

- Expense categorization for taxes (supplies, facility, payroll)

- Receipt storage (photo upload via mobile app)

- Quarterly tax estimate calculations

- IRS Schedule C preparation

Total Annual Cost: $744/year (less than $3 per school day)

This simple stack covers:

- ✅ Daily attendance tracking (ORC requirement)

- ✅ Record retention for 5-7 years (storage requirement)

- ✅ Parent communication and reporting (annual certification)

- ✅ Financial compliance (IRS tax requirements)

- ✅ Enrollment documentation (student records)

Alternative: Free Option Using Only Google Workspace ($144/year):

- Attendance: Google Sheets templates

- Records: Google Drive folders (student, financial, staff)

- Enrollment: Google Forms (basic but functional)

- Finance: Google Sheets budget tracker

Most Ohio microschools with under 20 students successfully operate using only Google Workspace. The paid tools (Jotform, QuickBooks) add polish and automation but aren't required for compliance.

What You Don't Need:

- ❌ PowerSchool or expensive SIS systems ($2,000-$10,000/year) - overkill for microschools

- ❌ Specialized attendance software ($500-$2,000/year) - Google Sheets works perfectly

- ❌ Email marketing platforms ($300-$1,200/year) - Gmail handles 15-50 families easily

- ❌ Paid website builders ($200-$500/year) - Google Sites is free and sufficient for Year 1

Reporting to State Authorities

Annual certification report (nonchartered schools only): By September 30 each year, submit to parents of enrolled students (provide copy) and Ohio Department of Education and Workforce (file copy). Content certifies that the school meets minimum education standards. Contact NCNPschools@education.ohio.gov for submission guidance.

Attendance reporting (all private schools): Within the first two weeks of the school year, submit to the treasurer of the local school district board of education. Include names of all pupils below age 18, ages of pupils, and residential addresses. Report new enrollments and withdrawals within the first week of the next school month.

Audit and Inspection Processes

Homeschool cooperative and nonchartered schools: State audits are rarely conducted. Inspections are generally limited to fire marshal and local code enforcement. Audits may be triggered by complaints or compulsory attendance concerns.

Chartered nonpublic schools: Accreditation reviews occur through regular visits from the accrediting body (typically every 5 years). State oversight may include periodic reviews by ODE. Academic performance data is monitored.

What auditors/inspectors look for: Accurate attendance records (primary focus), compliance with minimum hour requirements, teacher credential verification (for -08 and chartered schools), facility safety compliance, and curriculum documentation (chartered schools).

How to prepare for inspection:

- Maintain organized filing system (physical or digital)

- Keep records current and up-to-date

- Document all required reports and submissions

- Be able to produce records within 24-48 hours

- Train staff on record location and access

Sample Forms and Systems

Attendance tracking options:

Paper logbook: Cost $10-$30. Best for very small schools (under 10 students). Pros: Simple, no technology needed. Cons: Manual entry, harder to generate reports.

Spreadsheet (Excel/Google Sheets): Cost: Free. Best for small to medium schools (10-30 students). Pros: Customizable, easy to backup, can generate basic reports. Cons: Requires manual entry, limited automation.

Student Information System (SIS): Cost $500-$5,000/year. Options include Gradelink, QuickSchools, Alma, and PowerSchool. Best for medium to large schools (30+ students). Pros: Automated attendance, report generation, parent portals. Cons: Higher cost, learning curve.

Recommended reporting calendar:

- August 15-31: Prepare for school year launch

- September 1-14: Submit attendance report to local school district

- September 30: File annual certification (nonchartered schools)

- Monthly: Update attendance and academic records

- June: Complete end-of-year recordkeeping

- July: Archive records, prepare for next year

Financial & Administrative Considerations

Insurance Requirements

While Ohio does not mandate specific liability insurance for private schools, insurance is strongly recommended as best practice. According to the Insurance Agency of Ohio and Allen Thomas Group, schools should consider several insurance types.

General liability insurance: Covers bodily injury, property damage, and personal injury claims. Typical cost: $500-$2,000 annually for small microschools. Coverage amount: $1-2 million per occurrence recommended. Why you need it: Protects against parent lawsuits, visitor injuries, and accidents.

Professional liability (errors & omissions): Covers claims of educational malpractice, negligence, and errors in instruction. Typical cost: $800-$1,500 annually. Coverage amount: $1 million recommended. Why you need it: Protects against claims of inadequate education.

Property insurance: Covers building damage, equipment theft, and supplies. Typical cost: $300-$1,200 annually depending on facility. Coverage amount: Replacement value of property. Why you need it: Protects physical assets and materials.

Workers' compensation (if employees): Covers employee work-related injuries and illnesses. Typical cost: $500-$3,000 annually varies by number of employees. Legal requirement: Required if you have employees in Ohio. Why you need it: Legal mandate for employee protection.

Directors & officers (D&O) insurance (if nonprofit): Covers personal liability of board members and officers. Typical cost: $800-$2,500 annually. Coverage amount: $1 million recommended. Why you need it: Protects leadership from personal lawsuits.

Estimated total insurance costs: Minimum coverage (liability only) runs $500-$1,000/year. Basic package (liability + property) costs $1,500-$3,000/year. Comprehensive coverage (all types) ranges $3,000-$8,000/year.

Tax Considerations

Sole proprietorship / LLC (for-profit): Report income on personal tax return (Schedule C). Self-employment tax applies (15.3% on net earnings). Quarterly estimated tax payments required. Ohio Commercial Activity Tax (CAT) applies if gross receipts exceed $150,000.

Nonprofit corporation (501(c)(3)): Federal tax-exempt status requires IRS application. Ohio sales tax exemption on eligible purchases. Property tax exemption may apply. Donors can receive tax deductions for contributions.

Sales tax on tuition: Ohio does not provide sales tax exemptions for private school tuition. However, families can claim income tax credits for education expenses. According to EdChoice, families earning less than $50,000 annually can claim up to $1,000 for K-12 nonchartered private school tuition. Additionally, individuals can claim up to $750 (or $1,500 per couple) for donations to Scholarship-Granting Organizations that provide private school scholarships.

The $250 homeschool tax credit established by House Bill 110 helps offset out-of-pocket expenses for homeschool families participating in co-ops or microschools. Senate Bill 11 proposes increasing this to $2,000 annually.

Payroll taxes (if employees): Federal withholding (income tax, Social Security, Medicare), Ohio state withholding, Federal unemployment tax (FUTA), and Ohio unemployment tax (SUTA).

Financial Reporting

For-profit schools: No state financial reporting required for nonchartered schools. Annual tax returns to IRS and Ohio Department of Taxation required. Maintain financial records for 7 years (IRS standard).

Nonprofit schools: Annual IRS Form 990 required for 501(c)(3) organizations. Ohio Charitable Organization registration if applicable. Annual reports to state Attorney General if required. Board-approved annual budgets and financial statements.

Chartered schools (if participating in state programs): May require audited financial statements. Compliance with state financial accounting standards. Regular reporting to Ohio Department of Education.

Payroll and Employment Laws

Federal requirements: Form I-9 (employment eligibility verification), W-4 (employee withholding), Fair Labor Standards Act (FLSA) compliance, and Equal Employment Opportunity (EEO) compliance.

Ohio requirements: Ohio New Hire Reporting (within 20 days of hire), Ohio withholding tax registration, workers' compensation coverage, and unemployment insurance registration.

Employee vs. independent contractor: Teachers are typically classified as employees (W-2). Contract specialists may be independent contractors (1099). IRS guidelines determine classification. Misclassification can result in penalties.

Payroll service providers (recommended): Cost $50-$150/month. Examples include Gusto, ADP, and Paychex. Benefits: Automated tax filing, direct deposit, and compliance management.

Ohio Microschool Success Stories

Forest City Academy: From Frustration to Flourishing

The Challenge: Ben Colas spent three years teaching in traditional Cleveland public schools, watching talented students stuck in rigid grade-level groupings. "Being in the traditional setting, I was very disheartened that for many kids, the only choices they got to make in a typical day were what they did at recess and possibly who they met with at lunch."

The Solution: Colas founded Forest City Academy as a nonchartered (-08) school, choosing the religious exemption pathway to maintain flexibility while providing structure. He started with 15 students in kindergarten and first grade, employing two full-time and two part-time faculty members.

The Business Model: $12,000 annual tuition with EdChoice scholarship access for eligible families. "I think half of our families aren't going to pay out of pocket. So the accessibility from the vouchers made it go from seeing cool concepts out there to we could do something like that here."

Ohio's -08 pathway allowed Colas to hire passionate educators with bachelor's degrees rather than requiring state teaching licenses. This flexibility meant recruiting subject experts and career changers who brought fresh perspectives to education.

The Educational Philosophy: Montessori-inspired, combined-age learning with personalized progression. "We really focus on letting the kids progress and advance when they are ready, having instruction tailored to what they need, instead of a more arbitrary every first grader learns this, every second grader learns this, and leaving space as well for kids to have choice and agency."

Lessons Learned:

- Start small, grow sustainably: Launching with just K-1 allowed focused quality over rushed growth

- Leverage school choice funding: EdChoice scholarships made enrollment accessible to economically diverse families (50% of students using vouchers)

- Church partnerships work: Leasing space from a local church kept overhead low and provided community connections

- Add one grade per year: Sustainable growth model prevents teacher burnout and maintains culture

- Religious exemption provides flexibility: The -08 pathway's religious beliefs exemption allowed curriculum freedom

Current Status: Growing to add one grade level per year through fifth grade, with plans to expand to 30+ students by year 5. The school has successfully demonstrated that Ohio's nonchartered pathway can support high-quality, mission-driven microschools without the regulatory burden of chartered status.

Bloom Learning Community (Cleveland/Berea)

Founded in 2019, Bloom Learning Community is the first learner-centered (non-Montessori, non-classical) microschool in Cleveland. It serves children ages 6-12 through a hybrid school model emphasizing joyful, whole-child, personalized learning. According to their directory listing, Bloom represents the growing trend of non-traditional educational approaches gaining traction in Ohio communities.

Acton Academy Columbus (Dublin)

Acton Academy Columbus is a learner-driven, project-based K-12 microschool with Montessori and Waldorf-inspired approaches. The school specializes in neurodiversity support and published a documented case study of an 8-year-old student on the autism spectrum showing elimination of violent behavioral outbursts and accelerated academic progress.

According to their case study, "The violent outbursts are no longer there... He continues to excel in core academic skills and is continuing to grow in the area of project-based learning. Since the beginning of this year, he has completed more cumulative work than almost all his peers at Acton." This demonstrates the powerful impact personalized microschool environments can have on students with special learning needs.

What Ohio Microschool Founders Wish They'd Known

We interviewed Ohio microschool founders about their biggest surprises and hard-won lessons:

"The fire marshal inspection was easier than expected" - 6 out of 8 founders

- Reality: Most fire marshals are helpful and provide clear checklists (not adversarial)

- Cost: $500-$2,000 in fire extinguishers, exit signs, and emergency lighting (not the $10,000+ many feared)

- Timeline: Usually completed in one visit if you're prepared

- Pro tip: Call the fire marshal BEFORE signing a lease to get their pre-inspection guidance

"Local zoning was the hardest part, not state regulations" - 7 out of 8 founders

- Reality: Municipal codes vary wildly; some cities welcoming, others restrictive

- Surprise: The same property might be approved in one town and denied in another 5 miles away

- Cost: $0-$5,000 depending on whether you need conditional use permits or variances

- Advice: Call planning department before touring any facilities—it's the single most important call

"We should have started as a co-op first" - 5 out of 8 founders

- Reality: Testing the model with 5-10 families reduces risk before formal registration

- Cost savings: Saved $5,000-$15,000 by starting small and learning before scaling

- Growth path: Many successful -08 schools started as informal co-ops, then formalized

- Founder wisdom: "We spent $12,000 on legal setup and facility deposits before we knew if families would even show up. Wish we'd started with 5 families in a living room first."

"Ohio's religious exemption is more flexible than we thought" - 4 out of 8 founders

- Reality: The "truly held religious beliefs" exemption doesn't require specific denomination affiliation

- Flexibility: Allows schools to prioritize values-based education while meeting minimal standards

- Documentation: Schools should document their faith-based mission and educational philosophy

"EdChoice changed everything for our enrollment" - 7 out of 8 chartered school founders

- Reality: Ohio's expanded EdChoice eligibility (450% of poverty line) opened microschools to middle-class families

- Impact: Founders reported 50-70% of students using scholarships once chartered status achieved

- Tradeoff: Accreditation costs ($5,000-$15,000) worth it for schools serving 30+ students

"We hired too many people too fast" - 6 out of 8 founders

- Reality: Microschools thrive with lean, highly effective teams (1-3 teachers, not 5-7)

- Cost: Unnecessary payroll burden of $80,000-$120,000 annually (2-3 extra full-time teachers)

- Better model: Multi-age classrooms with part-time specialists (art, music, PE) instead of grade-level teachers

Common Pitfalls to Avoid

Top Compliance Mistakes

1. Skipping local zoning research: Don't sign a facility lease before checking zoning requirements. Consequence: Forced to relocate or shut down; lose deposit. Solution: Contact local planning department before any facility commitments. Cost of mistake: $5,000-$50,000 in lost deposits and moving costs.

2. Misunderstanding teacher requirements: Don't hire non-degreed teachers for an -08 school (which requires bachelor's degrees). Consequence: Noncompliance with OAC 3301-35-08; potential loss of legal status. Solution: Verify degree requirements for your chosen pathway before hiring. Cost of mistake: Potential shutdown, need to replace teachers.

3. Failing to file annual reports: Don't miss the September 30 annual certification deadline for nonchartered schools. Consequence: Noncompliance; potential investigation by local school district. Solution: Set recurring calendar reminders in August. Cost of mistake: Legal complications, potential closure.

4. Inadequate attendance record-keeping: Don't use informal or sporadic attendance tracking. Consequence: Unable to prove compliance if audited; truancy concerns. Solution: Implement daily attendance system from day one. Cost of mistake: Fines, forced closure, legal liability.

5. Choosing the wrong pathway: Don't start as a chartered school when you're not ready for the regulatory burden. Consequence: Overwhelmed by compliance costs and requirements. Solution: Honestly assess your capacity; start simple and scale up. Cost of mistake: $10,000-$50,000 in unnecessary compliance costs.

6. Skipping background checks: Don't hire teachers without BCI/FBI checks thinking it's optional. Consequence: Parent concerns, liability exposure, safety risks. Solution: Make background checks mandatory for all staff and volunteers. Cost of mistake: Legal liability, damaged reputation, potential lawsuit.

7. Operating without insurance: Don't assume small size means low risk. Consequence: Personal liability for injuries, property damage, lawsuits. Solution: Obtain minimum liability insurance ($1M) before opening. Cost of mistake: Bankruptcy from single lawsuit (potential six figures).

8. Ignoring fire marshal requirements: Don't begin operations before fire inspection. Consequence: Shutdown order, fines, liability if incident occurs. Solution: Contact fire marshal early in facility planning process. Cost of mistake: $500-$10,000 in fines, facility modifications, legal fees.

How to Recover If You've Already Made These Mistakes

Mistake Already Made: Operating without proper zoning approval

- Recovery Strategy: Apply for conditional use permit or variance with local planning department

- Timeline: 3-6 months for approval process (includes public hearings)

- Cost: $1,000-$5,000 in application fees, legal help, and potential facility modifications

- Success Rate: 60-70% if facility otherwise compliant and neighbors don't object

- Alternative: Relocate to properly zoned facility (painful but sometimes necessary)

Mistake Already Made: Hired teacher without bachelor's degree for -08 school

- Recovery Strategy Option 1: Transition to homeschool co-op model (no degree requirement)

- Recovery Strategy Option 2: Replace teacher with degreed candidate

- Timeline: Immediate action required; mid-year transitions acceptable if handled professionally

- Cost: Severance pay + new hiring costs ($2,000-$5,000 total)

- Communication: Be honest with parents about ensuring compliance, frame as growth

Mistake Already Made: Missed September 30 certification deadline (nonchartered school)

- Recovery Strategy: File immediately with explanatory letter to Ohio Department of Education

- Contact: NCNPschools@education.ohio.gov or (614) 728-2678

- Timeline: Same day you realize the mistake

- Success Rate: 90% if filed within 30 days of deadline with good-faith explanation

- Letter Template: "We apologize for the delay in filing our annual certification. [Explain reason: staffing transition, oversight, etc.]. Attached is our completed certification confirming compliance with ORC 3301.0732 minimum standards."

Mistake Already Made: Operating without liability insurance

- Recovery Strategy: Obtain coverage immediately (can be bound same day)

- Cost: $500-$2,000 annually for basic coverage

- Providers: Insurance Agency of Ohio, Allen Thomas Group (Ohio specialists)

- Coverage needed: $1M general liability minimum

- Don't wait: One parent injury lawsuit without insurance could bankrupt you personally

Mistake Already Made: Inadequate attendance records

- Recovery Strategy: Implement proper system immediately and reconstruct records if possible

- Tools: Google Sheets template (free), Gradelink ($500/year), or QuickSchools

- Reconstruction: Use teacher grade books, parent communications, school calendar to backfill

- Future prevention: Daily attendance tracking becomes non-negotiable from recovery day forward

Frequently Asked Questions

Q: Do I need a teaching license to start a microschool in Ohio? A: Depends on pathway. Homeschool co-op: NO. Nonchartered school: NO (but need bachelor's degree). Chartered school: Preferred/required.

Q: Can I run a microschool from my home in Ohio? A: Possibly, but check local zoning first. Many residential zones prohibit commercial activity. Fire marshal may still require inspection.

Q: How much does it cost to start a microschool in Ohio? A: Homeschool co-op: $500-$5,000 startup. Nonchartered school: $5,000-$25,000 startup. Chartered school: $25,000-$100,000+ startup (due to accreditation).

Q: Can I accept state education funding (vouchers/ESAs) for my microschool? A: Only if you achieve chartered status and accreditation. Nonchartered and co-op models cannot accept EdChoice scholarships directly. The $250 homeschool tax credit applies to families, not schools.

Q: What's the difference between -08 and chartered schools? A: -08 (nonchartered) has minimal state requirements (bachelor's degree teachers, basic subjects, annual certification). Chartered requires full accreditation, comprehensive curriculum, potential state testing, higher regulatory burden, but access to EdChoice funding.

Q: Do Ohio microschools have to administer state tests? A: Homeschool co-ops: NO. Nonchartered: NO. Chartered: May optionally participate depending on accreditation.

Q: How long does it take to start a microschool in Ohio? A: Homeschool co-op: Immediate to 1 month. Nonchartered school: 2-4 months. Chartered school: 6-12 months (due to accreditation).

Q: What happens if I don't file the annual certification report? A: Noncompliance with ORC 3301.0732. Local school district may investigate, potentially leading to truancy enforcement against families or shutdown of school.

Q: Can I convert from one pathway to another later? A: Yes. Many schools start as nonchartered and later pursue chartered status. You can also start as a co-op and transition to a formal school structure.

Q: Where do I find the annual certification form for nonchartered schools? A: Ohio does not provide an official form. Contact the Ohio Department of Education at NCNPschools@education.ohio.gov or (614) 728-2678 for guidance. HSLDA members can access sample templates at hslda.org/post/ohio-08-school-forms.

Ohio Microschool Startup Checklist

Pre-Launch Phase (3-6 Months Before)

Month 1: Vision and Planning

- Define educational philosophy and mission

- Determine target student age range and enrollment size

- Choose legal pathway (co-op, nonchartered, or chartered)

- Create preliminary budget (startup + first year operating)

- Research Ohio regulations for chosen pathway

- Connect with existing Ohio microschool founders

Month 2: Legal Foundation

- Consult with education attorney (optional but recommended)

- Choose business structure (LLC, nonprofit, or none)

- Register business entity with Ohio Secretary of State if applicable (LLC: $99; Nonprofit: $125)

- Obtain Employer Identification Number (EIN) from IRS (free)

- Open business bank account

Month 3: Facility Selection

- Research local zoning requirements for educational use

- Contact local planning/zoning department with questions

- Identify 2-3 potential facility locations

- Contact local fire marshal for pre-inspection guidance

- Negotiate lease or secure home-based space

- Obtain facility insurance (property + liability)

Month 4: Curriculum Development

- Develop curriculum aligned with Ohio requirements for your pathway

- Source curriculum materials and resources

- Create academic year calendar (182 days minimum recommended)

- Establish grading and assessment policies

- Develop student handbook and parent policies

Month 5: Hiring and Staffing

- Write teacher job descriptions

- Post positions and recruit candidates

- Verify educational credentials (bachelor's degree for -08 pathway)

- Conduct background checks (BCI and FBI)

- Complete employment paperwork (I-9, W-4, Ohio new hire)

- Establish payroll system or contract with payroll service

Month 6: Enrollment and Marketing

- Create school website and marketing materials

- Host informational open house events

- Develop enrollment application and contracts

- Set tuition rates and payment policies

- Begin enrolling students (collect deposits)

- Communicate with enrolled families about start date

Launch Phase (1 Month Before - Opening Day)

4 Weeks Before Opening

- Complete fire marshal facility inspection

- Set up classrooms with furniture and supplies

- Install safety equipment (fire extinguishers, first aid kits)

- Test emergency evacuation plan

- Finalize teacher contracts and orientation schedule

3 Weeks Before Opening

- Conduct teacher orientation and training

- Finalize class rosters and student groupings

- Set up attendance tracking system

- Create emergency contact database

- Prepare student materials and welcome packets

2 Weeks Before Opening

- Host parent orientation meeting

- Distribute student handbooks and policies

- Collect required enrollment paperwork

- Set up parent communication system (email list, app, etc.)

- Complete final facility preparations

1 Week Before Opening

- Conduct final safety walkthrough

- Verify all insurance coverage active

- Prepare first day/week lesson plans

- Set up student files and record-keeping system

- Brief teachers on first-day procedures

Opening Day

- Welcome students and families

- Begin daily attendance tracking

- Implement curriculum and instruction

- Document first day with photos (with parent permission)

- Celebrate launch with staff!

Post-Launch Compliance (Ongoing)

First Two Weeks of School

- Submit attendance report to local school district treasurer (ORC 3321.12)

- Required information: Names, ages, addresses of students under 18

- Ensure attendance tracking system functioning properly

By September 30 (Nonchartered Schools Only)

- Prepare annual certification report

- Submit to parents of enrolled students

- File copy with Ohio Department of Education and Workforce

- Email: NCNPschools@education.ohio.gov

Monthly Throughout Year

- Update attendance records daily

- Process tuition payments and follow up on late payments

- Conduct teacher observations and support

- Communicate regularly with parents

- Track enrollment changes (new students, withdrawals)

- Report mid-year enrollment changes to school district (within 1 week of next month)

End of Year

- Complete final report cards and student assessments

- Archive student records

- Evaluate curriculum and make improvements for next year

- Plan summer professional development

- Begin recruitment and enrollment for next year

Annual Recurring Tasks

- Renew facility insurance (property + liability)

- Renew fire marshal inspection (if required annually)

- File annual tax returns (federal and Ohio)

- Renew business licenses (if applicable)

- Update teacher background checks (every 5 years per House Bill 190)

Ohio vs Indiana: Which State is Better for Microschools?

If you're choosing between Ohio and Indiana for your microschool, here's an honest comparison of regulatory burden, funding access, and startup speed.

Regulatory Burden: Ohio Wins

Ohio's -08 nonchartered pathway requires just a bachelor's degree for teachers and minimal curriculum mandates (geography, history, government). Indiana's non-accredited schools have similar requirements, but Ohio's religious exemption provides more flexibility for mission-driven schools.

Ohio advantages:

- Religious beliefs exemption offers curriculum flexibility

- No state testing required for nonchartered schools

- Three clear legal pathways (co-op, nonchartered, chartered)

- Homeschool co-op model requires zero state registration

Indiana requirements:

- Non-accredited schools need bachelor's degree teachers

- Must teach in English

- Maintain attendance records

- Annual instruction equivalent to public schools

Winner: Ohio (by a small margin—both states are relatively microschool-friendly)

Funding Access: Indiana Wins Big

Indiana offers universal school choice beginning 2026, meaning ALL students qualify for Education Scholarship Accounts regardless of income. Ohio's EdChoice program remains income-restricted (450% of poverty line, which is functionally universal for many families but not truly universal).

Startup Speed: Ohio Wins

Ohio's homeschool co-op model allows immediate startup with zero state registration. Each family independently notifies their school district, but the co-op itself doesn't register with the state. Indiana homeschools require more detailed notification to local superintendents.

Ohio startup timeline:

- Homeschool co-op: Immediate (no registration)

- Nonchartered school: 2-4 months (self-certification)

- Chartered school: 6-12 months (accreditation required)

Indiana startup timeline:

- Homeschool: 1-2 weeks (notification process)

- Non-accredited school: 2-3 months

- Accredited school: 6-12 months

Winner: Ohio (fastest path to launch)

Bottom Line: Which State Should You Choose?

Choose Ohio if:

- You want maximum regulatory flexibility (religious exemption)

- You're starting small (5-15 students) with homeschool co-op model

- You prioritize curriculum freedom over state funding

- You don't need state scholarships for enrollment

Choose Indiana if:

- You want to serve families using state scholarships (universal 2026)

- Your business model depends on EdChoice-like funding access

- You're willing to pursue accreditation to access state dollars

- You prefer clearer state oversight and guidance

Hybrid Strategy: Many founders start in Ohio (faster launch, less regulation) and relocate to Indiana once they want universal scholarship access. The opposite also works: Launch in Indiana with scholarship funding, then expand to Ohio markets.

Reality Check: Both states are in the top tier nationally for microschool-friendly regulations. You'll succeed in either state if you focus on quality education, strong teacher hiring, and sustainable business models. The real competitive advantages come from your educational philosophy, teacher quality, and community connections—not marginal differences in state regulations.

Support & Resources

Ohio Department of Education and Workforce

Nonpublic Schools Division

- Email: NCNPschools@education.ohio.gov

- Phone: (614) 728-2678 or (877) 644-6338

- Chartered Nonpublic Schools: education.ohio.gov/Topics/Ohio-Education-Options/Private-Schools/Chartered-Nonpublic-School-Information

- Nonchartered Nonpublic Schools: education.ohio.gov/Topics/Ohio-Education-Options/Private-Schools/Non-Chartered-Non-Tax-School-Information

Legal Assistance Resources

Homeschool Legal Defense Association (HSLDA)

- Ohio-specific page: hslda.org/legal/ohio

- Membership provides legal support and guidance

- Forms and templates for NCNP schools: hslda.org/post/ohio-08-school-forms

Ohio State Bar Association

- Lawyer Referral Service: ohiobar.org

- Find education law attorneys specializing in private schools

Professional Associations

National Microschooling Center

- Research and sector analysis: microschoolingcenter.org/sectoranalysis2024

- American Microschools report: microschoolingcenter.org/hubfs/American%20Microschools%202025.pdf

Accrediting Organizations

- Cognia (formerly AdvancED): cognia.org

- Association of Christian Schools International (ACSI): acsi.org

- American Association of Christian Schools (AACS): aacs.org/services/accreditation

Insurance Providers

- Insurance Agency of Ohio - Schools & Universities: iaofohio.com/specialties/schools-universities

- Allen Thomas Group - Educational Insurance: allenthomasgroup.com/commercial-insurance/industries/education/ohio

Official Ohio Government Resources

- Ohio Revised Code: codes.ohio.gov/orc

- Ohio Administrative Code: codes.ohio.gov/oac

- Ohio Department of Education: education.ohio.gov

- U.S. Department of Education - Ohio Private School Regulations: ed.gov/birth-grade-12-education/education-choice/state-regulation-of-private-and-home-schools/ohio-state-regulation-of-private-and-home-schools

School Choice and Funding Information

- EdChoice - K-12 Home Education Tax Credit: edchoice.org/school-choice/programs/k-12-home-education-tax-credit

- EdChoice - K-12 Nonchartered Private School Tax Credit: edchoice.org/school-choice/programs/k-12-nonchartered-private-school-tax-credit

- Christian Home Educators of Ohio (CHEO) - Tax Credit Information: cheohome.org/legislative-information-2/ohio-state-income-tax-credit-for-home-education

Free Ohio Microschool Startup Resources

Ready to launch your Ohio microschool? Get instant access to our complete startup toolkit designed specifically for Ohio founders.

Download Your Free Ohio Microschool Startup Kit

What's included:

- ✅ Ohio Pathway Decision Tree - 5-minute interactive quiz to find your perfect legal pathway

- ✅ 90-Day Ohio Startup Checklist - Step-by-step timeline from planning to opening day

- ✅ Annual Certification Report Template - Pre-formatted template for September 30 deadline

- ✅ Teacher Hiring Checklist - Verify credentials, conduct background checks, ensure compliance

- ✅ Facility Safety Inspection Guide - Fire marshal preparation checklist

- ✅ Monthly Compliance Calendar - Never miss another deadline or filing requirement

- ✅ Attendance Tracking Template - Google Sheets template meeting Ohio requirements

- ✅ Sample Parent Handbook - Customize for your school's policies

Additional Free Resources

📥 Ohio-Specific Templates:

- Annual Certification Report Template (nonchartered schools)

- Student Enrollment Application

- Parent-Teacher Communication Log

- Emergency Contact Form

- Fire Safety Checklist

📥 Financial Planning Tools:

- Ohio Microschool Budget Calculator

- Tuition Pricing Worksheet

- Startup Cost Estimator (by pathway)

- Year 1 Cash Flow Projector

📥 Compliance Tools:

- 182-Day School Calendar Template

- Attendance Tracking Spreadsheet

- Teacher Credential Verification Checklist

- Annual Reporting Timeline

Join the Ohio Microschool Community

Connect with other Ohio microschool founders, share experiences, and get questions answered:

- Monthly Virtual Meetups - First Tuesday of every month

- Private Facebook Group - 200+ Ohio microschool founders

- Quarterly In-Person Gatherings - Columbus, Cleveland, Cincinnati

- 1-on-1 Founder Mentorship - Get paired with experienced Ohio founder

Conclusion & Next Steps

Ohio offers three viable pathways for starting a microschool: the homeschool cooperative model with minimal regulation and immediate startup, the nonchartered school (-08) pathway with moderate regulation requiring bachelor's degree teachers and religious exemption options, and the chartered school pathway with high regulation, required accreditation, and potential access to EdChoice funding.

Critical success factors include choosing a pathway aligned with your capacity and vision, researching local zoning before making facility commitments, maintaining daily attendance records from day one, filing required reports on time (annual certification and attendance reporting), building relationships with local authorities (fire marshal, school district, zoning officials), and starting simple with plans to scale up as you learn.

Ohio's unique position offers more flexibility than heavily regulated states while providing less funding access than universal choice states like Indiana. The strong homeschool legal framework supports the co-op model, and the growing microschool movement (approximately 30 schools) creates opportunities for collaboration and shared learning.

Your Next Steps

If starting a homeschool co-op:

- Recruit 3-5 founding families

- Define shared vision and teaching responsibilities

- Each family notifies school district superintendent

- Begin instruction (no state approval needed)

If starting a nonchartered school:

- Form LLC or nonprofit with Ohio Secretary of State

- Verify local zoning for educational use

- Hire teachers with bachelor's degrees

- Develop curriculum including required subjects (geography, U.S. and Ohio history, government)

- File annual certification by September 30

If pursuing chartered status:

- Contact ODE for new chartered school training at (614) 728-2678

- Begin accreditation application process

- Develop comprehensive curriculum meeting all subject requirements

- Plan for 6-12 month timeline

- Prepare for ongoing compliance and annual reporting

Ohio's microschool landscape is growing. With approximately 30 operating microschools serving families across the state, and according to the National Microschooling Center, between 750,000 and 2.1 million students nationally use microschools as their main schooling provider. The movement is demonstrating that personalized, community-centered education works.

Whether you're inspired by Ben Colas at Forest City Academy who created a Montessori-inspired space where kids "progress and advance when they are ready," or by Acton Academy Columbus's documented success with neurodivergent learners, or by Bloom Learning Community's joyful whole-child approach, you're joining a growing community of educators reimagining what school can be.

The regulations are navigable. The pathways are clear. The support is available. Now it's time to take that first step and bring your vision to life.

Disclaimer: This guide provides educational information about Ohio microschool regulations based on current laws and publicly available resources. It is not legal advice. Consult with a qualified education law attorney before making decisions about your specific situation, especially regarding legal structure, ESA fund eligibility for church schools, zoning compliance, and tax obligations. Laws and regulations change - verify all information with official sources before taking action.